Led by Abel Avellan, founder and CEO of AST SpaceMobile, Ticker: ASTS, the Texas-based company is disrupting Starlink and boasts a disruptive technology protected by 3,500 patents. Five first-generation satellites are already operational in orbit.

1. SPACE MARKET OPPORTUNITY

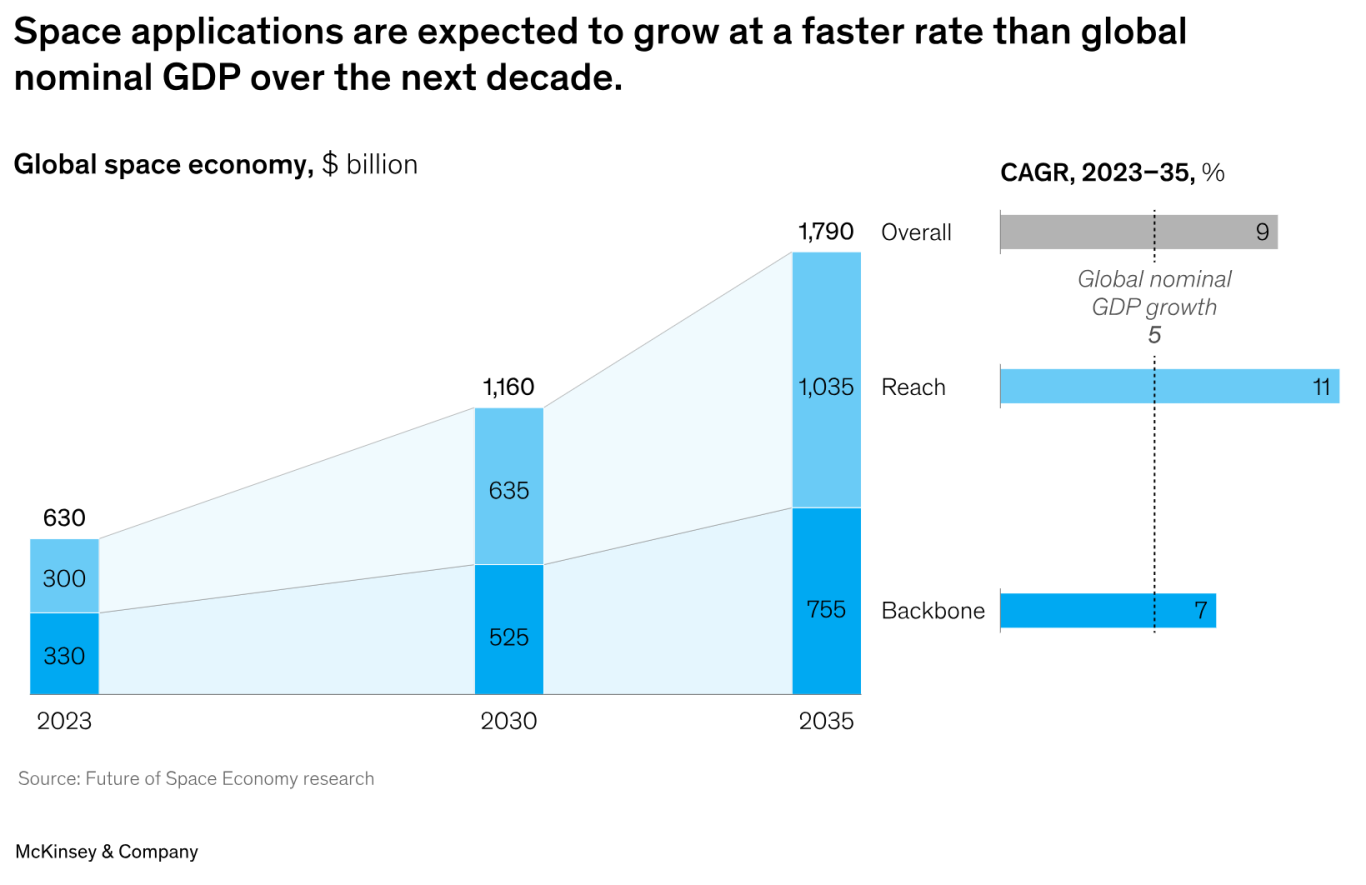

The "Space: The $1.8 Trillion Opportunity for Global Economic Growth" report by McKinsey & Company and the World Economic Forum highlights the tremendous growth potential of the space economy, which is projected to reach $1.8 trillion by 2035, up from $630 billion in 2023.

Space can be divided into two major fields: “backbone” tech., which include satellites, launchers, and essential infrastructure, and “reach” applications, which leverage these tech. for industries on Earth, such as transportation, agriculture, and digital communications. Key growth areas include satellite connectivity, navigation services, and data solutions, which support industries from logistics to climate monitoring.

The total revenue of the global mobile services market alone is estimated at $1.1 trillion. ASTS wants a large share of that pie.

2. Founding and IPO

The company was founded in 2017 by Abel Avellan, who previously founded and sold Emerging Markets Communications, a provider of satellite communications services.

Abel Avellan is the largest single shareholder with 78 million Class C shares.

There are three types of ASTS shares:

– A: Traded on NASDAQ

– B: Early Investors

– C: Abel Avellan

Voting Rights:

– A & B: 1 vote per share

– C: 10 votes per share

✅ The CEO's wealth is tied to the company's performance.

✅ Long-term commitment to growth.

✅ Strong signal of confidence for investors.

Abel Avellan controls 79% of the company, although he only owns 27% of the shares. Abel Avellan has long-standing industry relationships. Investors in ASTS include Vodafone, Verizon, ATT, and Rakuten Group. But even Google is on board with its expertise.

The SPAC IPO took place in 2021. ASTS went public through a SPAC merger with NPA. This move initially raised ASTS $462 million to accelerate the expansion of its space-based mobile network.

3. Technology

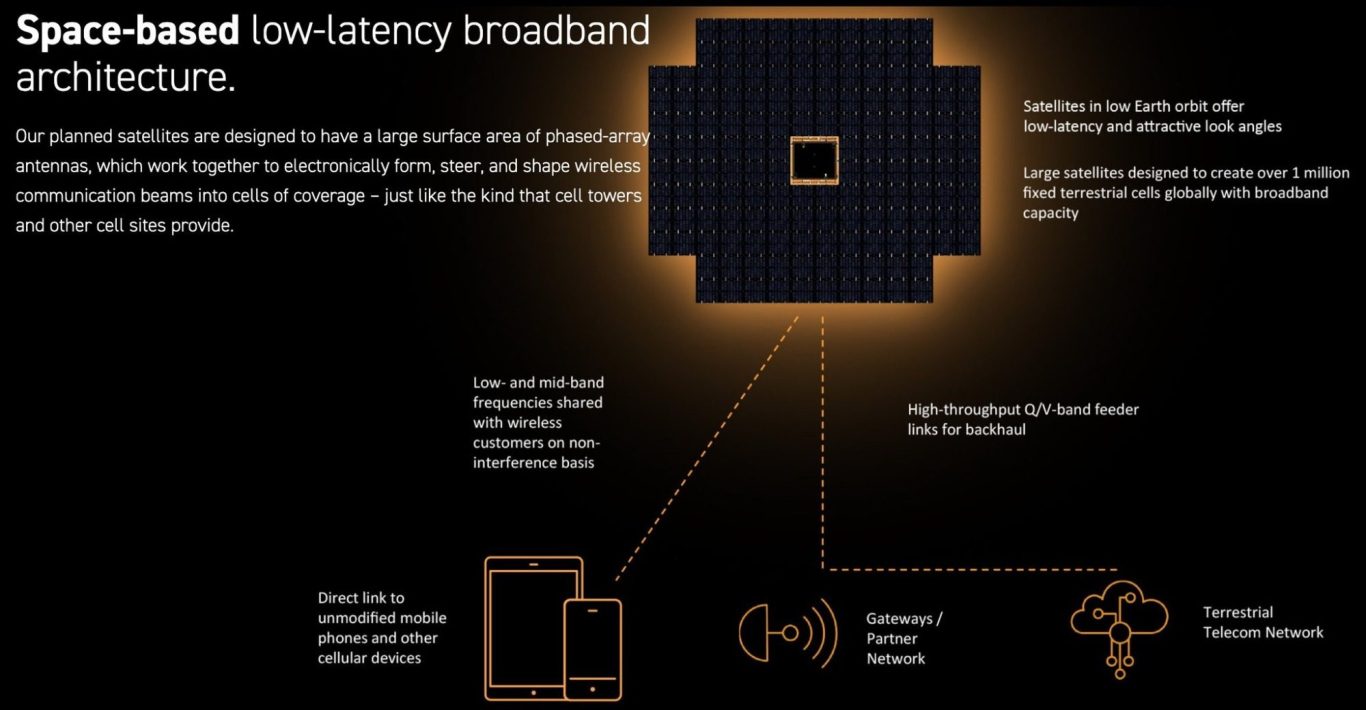

This space-based mobile broadband network, also known as "satellite-to-cell technology," operates via the so-called BlueBird satellites. These are essentially cell phone towers in orbit and thus the largest of their kind, capable of processing huge amounts of data.

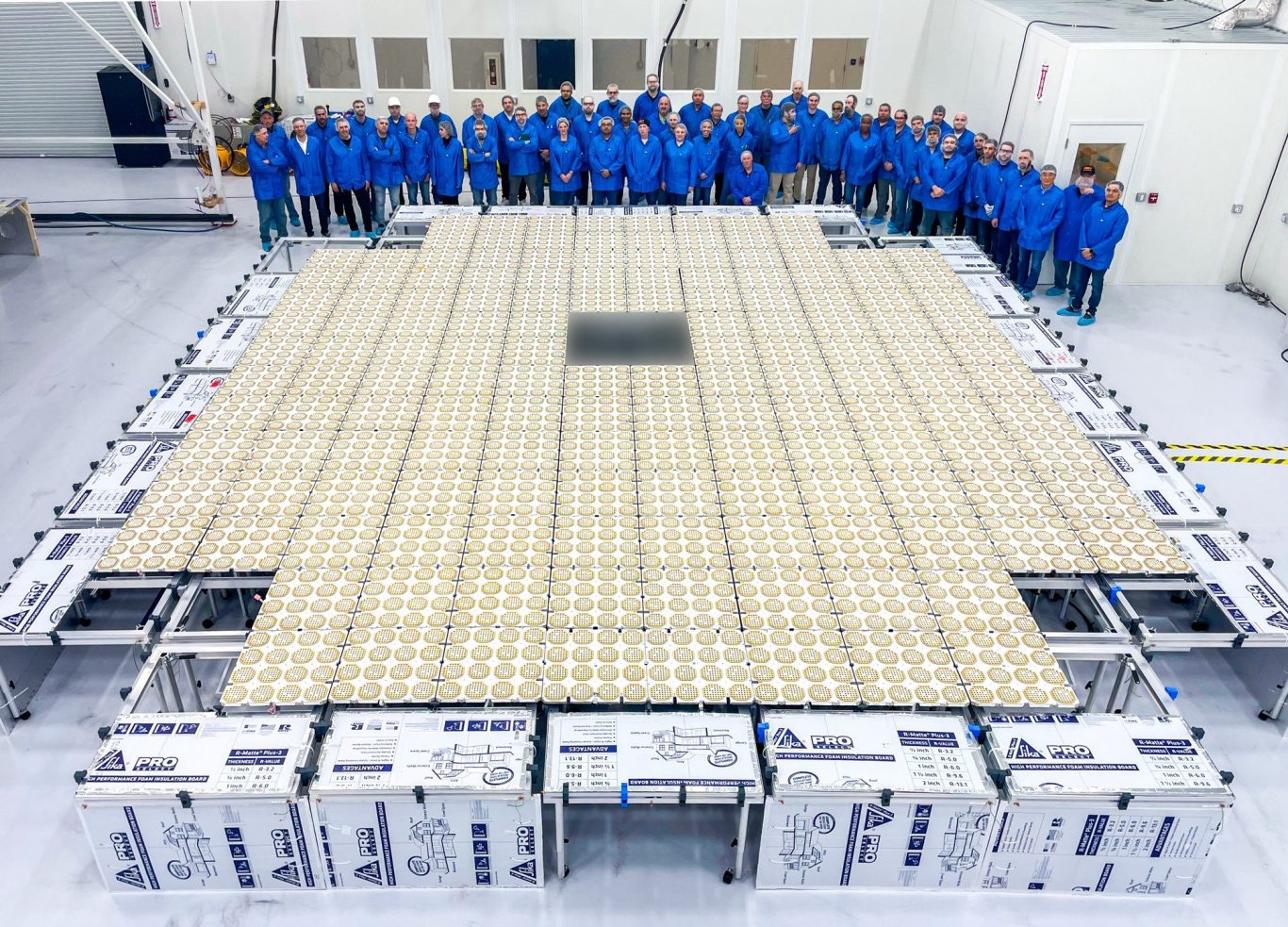

The second-generation satellites cover an area of 2,400 square feet, three times larger than the first-generation ones. The ASTS technology is based on phased array antennas that can electronically steer and shape wireless communication beams.

The technology enables smartphones to connect directly to satellites. This means that the space-based mobile broadband network directly via smartphones makes physical terminals, such as those used by Starlink or Iridium, obsolete.

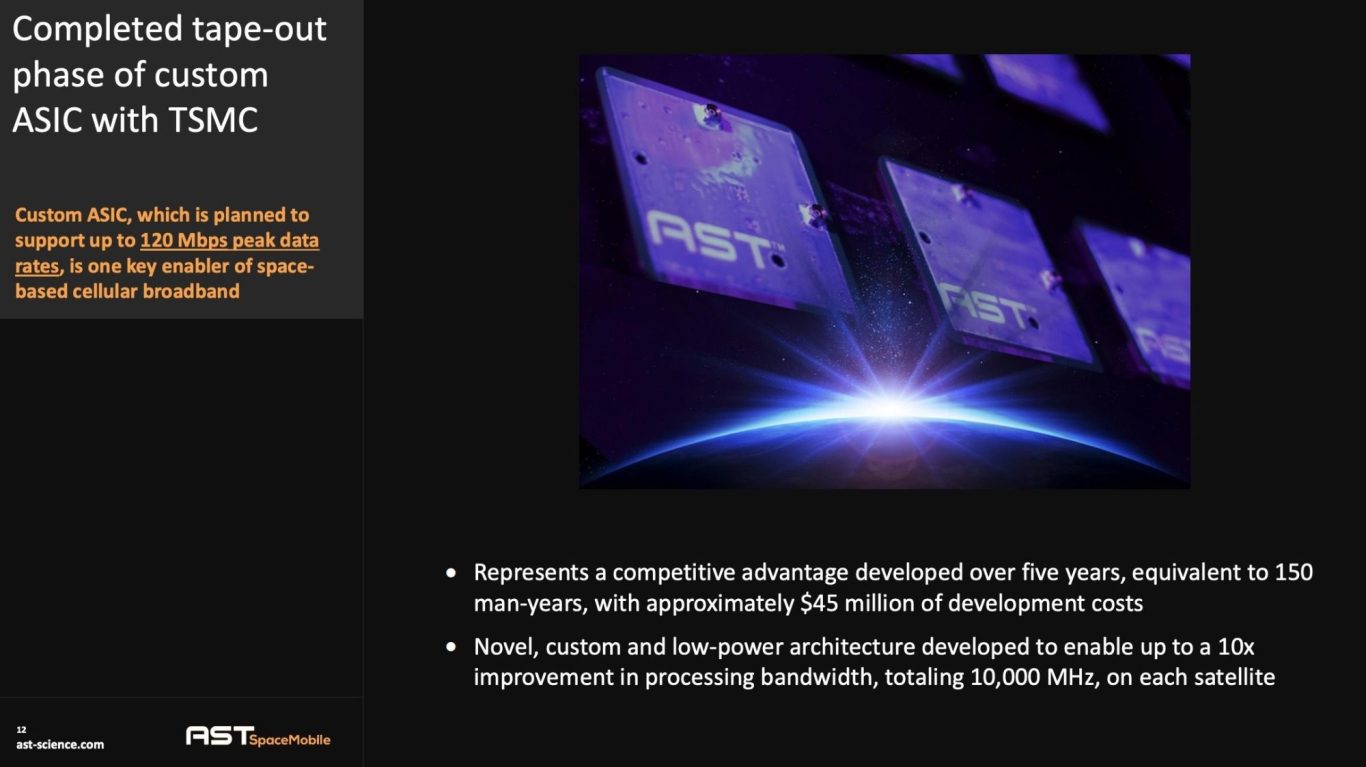

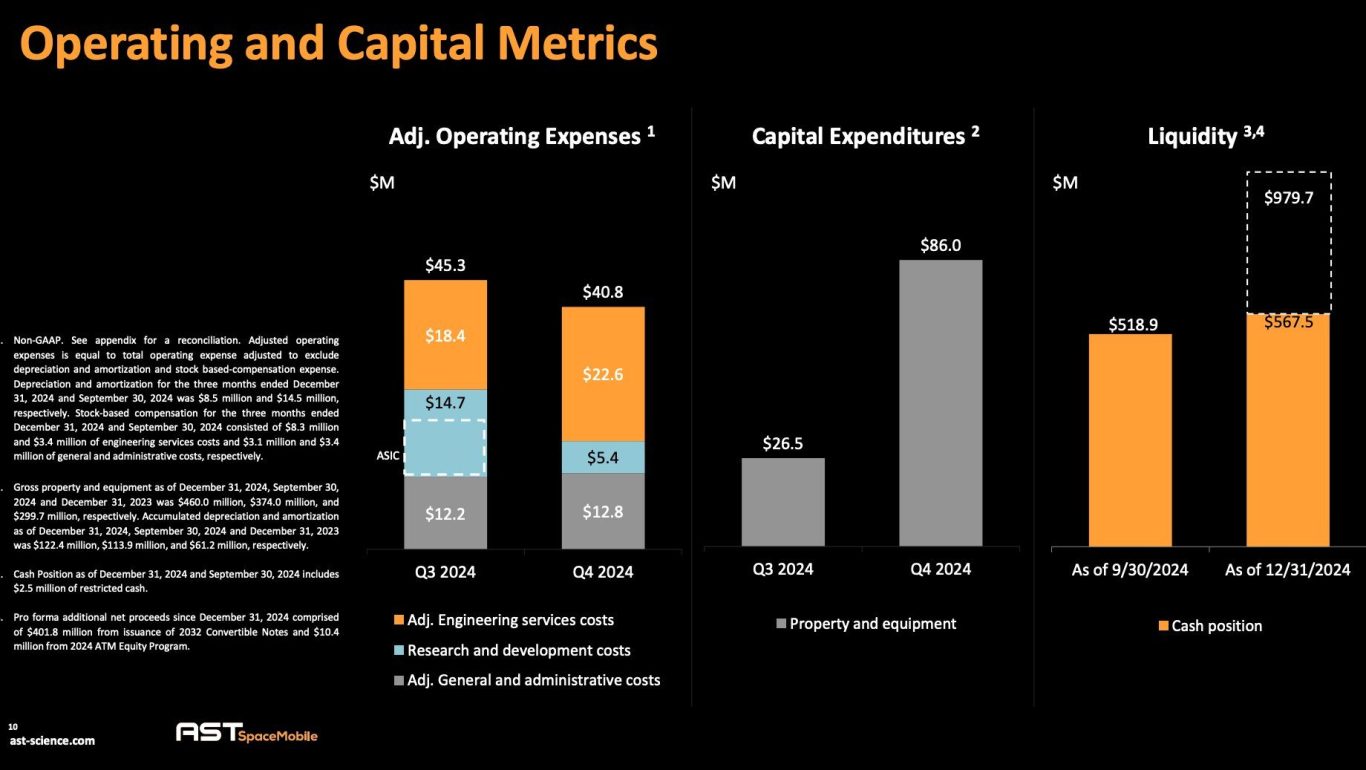

The heart of the satellites are the ASIC chips, which support a processing bandwidth of up to 10,000 MHz per satellite with peak data transmission speeds of up to 120 Mbit/s

4. Business Model

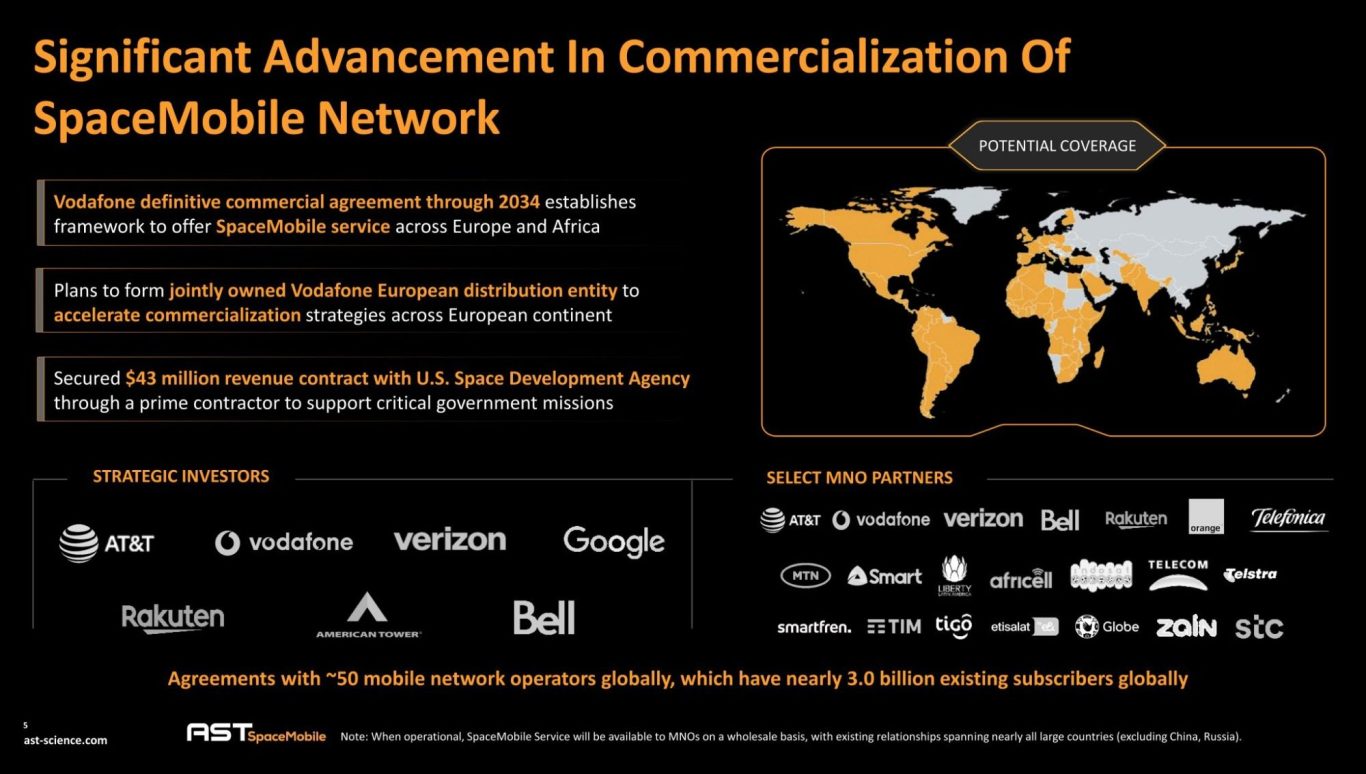

ASTS aims to make its broadband satellite constellation available to network operators worldwide. These operators, in turn, are responsible for marketing the service to their end customers. For this purpose, ASTS has created a B2B infrastructure: ASTS has signed agreements with nearly 50 MNOs, representing nearly 3 billion potential customers. These partnerships ensure integration into existing mobile networks and provide seamless service worldwide.

Through its partnership with ATT and Verizon ASTS can provide nearly 100% nationwide broadband coverage to 70% of the US population via their smartphones. How does ASTS make money? Through a revenue-shared model: ASTS will generate revenue through profit-sharing agreements, whereby the telecom partners leverage their subscriber base to acquire customers. ASTS will receive a 50% share of the revenue from the Spacemobile service. This is a huge advantage: Mobile network operators have a large user base to which they can sell new services. This means ASTS doesn't have to build its own infrastructure, saving immense costs.

5. Vertically integrated

95% of the business is vertically integrated, encompassing manufacturing, assembly, and testing. Global production takes place at approximately 18,000 m² in Midland, Texas, approximately 5,500 m² in Barcelona, Spain, and soon approximately 7,900 m² in Homestead, Florida.

6. Regulation and Competition

A strong regulatory position is a cornerstone of a robust competitive advantage, especially in highly regulated industries such as telecommunications and aerospace. ASTS has successfully positioned itself in the complex regulatory landscape. This early regulatory success gives the company a significant lead over its competitors, who are still struggling with similar challenges. Similar to ASTS, Starlink will leverage the spectrum of its partner T-Mobile, allowing existing smartphones to use the service. Starlink already has a large Starlink constellation in orbit and has already deployed services online. The Starlink D2D service will transmit SMS and eventually voice/data and requires a clear view of the sky for access. Starlink is limited to a 5 MHz channel in the S-band, which limits speed and must overcome interference issues. ASTS is designed from the ground up for direct-to-cell connectivity, enabling ASTS to offer voice, text, and data services, including high-speed data services. Compared to ASTS's bespoke approach, Starlink will face performance and integration limitations despite retrofitting.

7. Valuation Gap

ASTS is valued at $8 billion, and Starlink at $227.5 billion. That's a significant valuation difference! In the direct-to-cellular market, with a volume of over $48 billion, two to three players will prevail. ASTS has the best technology and secures a large share of the global market through its 50 MNO partnerships. The defense and government business also offers ASTS immense advantages. ASTS recently received a $43 million contract to support the U.S. space agency.

8. Financials

ASTS Q4'24 Highlights: "The many pieces of our plan are rapidly coming into place," said Abel Avellan, Founder, Chairman and CEO of AST SpaceMobile during the Earnings Eall on the 3rd of March.

Q4 GAAP EPS of -$0.18 in-line

Revenue of $1.92M misses by $0.46M.

Highlights:

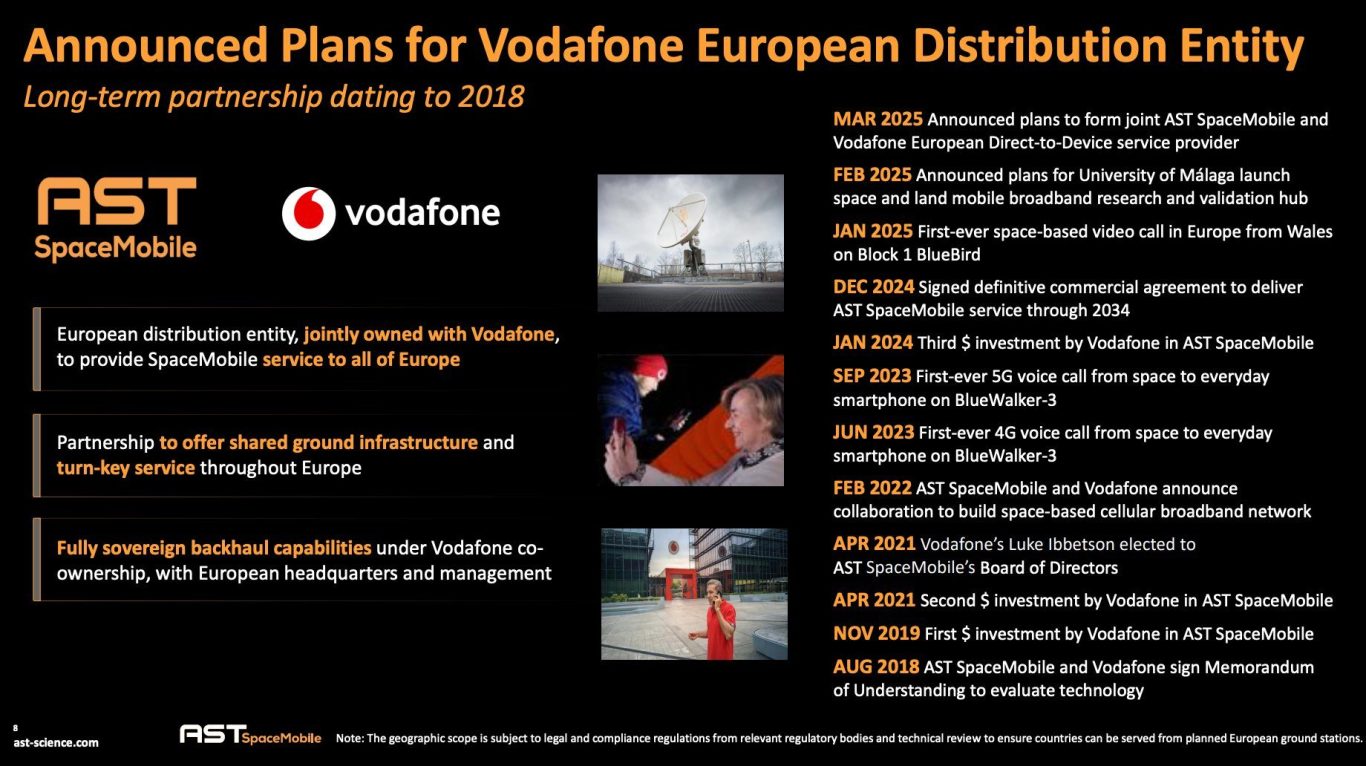

- AST SpaceMobile announced a Definitive Commercial Agreement with Vodafone Through 2034.

- AST SpaceMobile secured contract for $43.0 million in expected revenue with the U.S. Space Development Agency (SDA).

- Demonstrations of two-way video call transmission with Vodafone using unmodified smartphones in premium low-band wireless spectrum.

- AST SpaceMobile received FCC grant of Special Temporary Authority (STA) with AT&T and Verizon in the U.S. to facilitate initial services, targeting approximately 100% nationwide coverage from space with over 5,600 coverage cells

- Production of 40 Block 2 BlueBird satellites underway.

- Exercised option for additional orbital launches, with full contracted launch capacity now for approximately 60 satellites during 2025 and 2026.

- Validation of novel ASIC chip to support up to 10,000 MHz in processing bandwidth per satellite with peak data transmissions speeds of up to 120 Mbps.

- Block 2 BlueBird satellites span an unprecedented 2,400 square feet, more than 3x larger than the first five BlueBirds.

- Spectrum agreement for long-term access to up to 45 MHz of premium lower mid-band spectrum in the U.S. for direct-to-device applications will enable peak data transmission speeds of up to 120 Mbps nationwide.

- Robust balance sheet with nearly $1.0 billion in cash

- The company aims to raise strategic capital through non-dilutive approaches, Therefore progress is made with quasi-governmental sources of capital, with applications in process for over $500.0 million.

In 2024, operating expenses increased from $222 million to $247 million. Capital expenditures increased significantly compared to the previous quarter. The BlueBirds from Building Block 2 and the new ASTS office in Barcelona contributed significantly. ASTS expects capital expenditures to continue to increase as satellite production increases to six satellites per month starting in the second half of 2024 and payments for scheduled launches continue. ASTS has nearly $1 billion in cash.

- 25 satellites are needed to generate revenue.

- 45–60 satellites are needed for continuous operation in the US.

- 60 launch contracts have been secured, including with SpaceX and Blue Origin.

- Planned coverage of Europe, the US, Japan, and other markets.

- Blue Origin can carry 8 satellites per launch.

- One launch every 45 days (later in 2025).

- Currently, 40–53 satellites are being manufactured.

- Cost per satellite: $19–21 million.

My conservative calculations would result in a share price of $331 in 2030. Of course, there may be delays and other risks, such as regulatory risks, competition, and others.

Source: https://www.gryden.se/asts/index.php?subs=101&rev=5&otherrev=493&opex=326&ev=30&shares=347

Anyone who bought ASTS at the beginning of 2024 enjoyed an incredible 825% increase. My entry price is now $6

9. Analysts

If you look at the analysts' estimates, you can see that they see considerable upside potential.

Deutsche Bank forecasts ASTS free cash flow of $3.5 billion by 2030! The market capitalization of AST SpaceMobile

is currently $8 billion. Deutsche Bank also rates ASTS as a Buy with a price target of $64.

10. Services in Europe

Vodafone and ASTS signed an agreement on March 3, 2025, to establish a European joint venture called SatCo. SatCo. will distribute ASTS satellite services exclusively to European mobile network operators and ensure 100 percent geographical coverage in all parts of Europe.

11. Conclusion

AST SpaceMobile is a pioneering company in the field of satellite communications, with a bold and transformative mission: to deliver broadband connectivity directly to standard mobile phones, anywhere in the world - with no need for satellite phones or ground-based towers. AST SpaceMobile has the potential to revolutionize global connectivity. If successful, it could become a game-changer for digital inclusion, disaster response, rural development, and much more - essentially becoming a "cell tower in space" that connects the unconnected.

Their moat is centered around these fields:

📱 Works with Standard Smartphones

🛰️ Technological Edge

🤝 Strong Industry Partnerships

📈 Big Market Opportunity

©Copyright. All rights reserved.

Wir benötigen Ihre Zustimmung zum Laden der Übersetzungen

Wir nutzen einen Drittanbieter-Service, um den Inhalt der Website zu übersetzen, der möglicherweise Daten über Ihre Aktivitäten sammelt. Bitte überprüfen Sie die Details in der Datenschutzerklärung und akzeptieren Sie den Dienst, um die Übersetzungen zu sehen.